In the world of business, many decisions can ripple through the financial fabric of an organisation. Consider a retail store deciding to extend its opening hours. This move could potentially increase sales by attracting more customers during late hours, yet it also means higher operating costs, such as wages for staff and utility expenses. Similarly, a software company contemplating offering its new app for free, banking on future revenue from in-app purchases and advertisements, faces the risk of not generating enough engagement to cover initial development costs. Each of these decisions involves weighing potential revenue growth against the upfront and ongoing costs, illustrating the delicate balance businesses must navigate. Successfully evaluating and making these decisions requires an understanding of finance. Those with the ability to make good decisions are said to have sound financial acumen. But what is financial acumen?

Financial acumen is the ability to understand and apply financial principles and data to make informed decisions, influence outcomes, and drive improvements in the financial health of a business or organisation. It encompasses a broad set of skills, including reading and interpreting financial reports, budgeting, forecasting, and recognising the broader economic implications of business decisions.

A prevalent misconception is that financial acumen is a binary trait: you either possess it or you don’t. However, the reality is far more nuanced, with financial acumen existing across a spectrum of levels depending on the complexity and nature of financial decisions at hand. For instance, an entry-level employee might only need the acumen to understand basic financial reports published by the organisation, while a department manager requires a deeper understanding to analyse financial performance, manage larger budgets, and make investment decisions. At the executive level, the acumen extends into strategic financial planning, mergers and acquisitions, and possibly global market expansion. This differentiation underscores the notion that the requisite level of financial acumen is intricately linked to one’s role within an organisation; roles with greater financial influence necessitate a higher degree of financial insight.

Additionally, an individual’s career aspirations play a crucial role—aiming for leadership positions demands an elevation in financial understanding to navigate the complex financial landscapes, make informed decisions, and drive the organisation towards its financial goals.

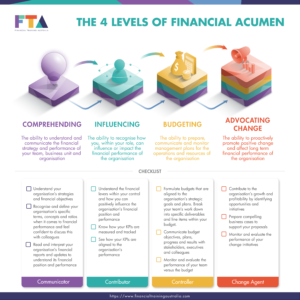

Drawing on years of deep engagement and collaboration with our clients, we’ve developed a dynamic framework of financial acumen, categorising it into four distinct levels that resonate across the organisational spectrum. These are:

1. Comprehending – The ability to understand and communicate the financial strategy and performance of your team, business unit and organisation.

2. Influencing – The ability to recognise how you, within your role, can influence or impact the performance of the organisation.

3. Budgeting – The ability to prepare, communicate and monitor management plans for the operations and resources of the organisation.

4. Advocating Change – The ability to proactively promote positive change and affect long term performance of the organisation.

Under this framework, financial acumen develops in a hierarchical fashion, where mastery of each level serves as the cornerstone for advancing to the next. It’s a journey of accumulation, where the foundational wisdom of the initial stages paves the way for the intricate learning and strategic prowess required at the apex.

Level 1: Comprehending – The ability to understand and communicate the financial strategy and performance of your team, business unit and organisation.

All businesses are run on financial data which captures information on the collective activities and tasks performed by members of the organisation. The data is then collated, summarised and reported on by the finance team in accordance with the accounting rules and principles.

For those unfamiliar with finance, it can seem like a foreign language. In some respects, this is true. The reports are written in the language of finance, with its own style, formats and rules. Therefore, unless you understand this language, you will struggle to comprehend what it means and therefore unable to put that information to work. This can lead to poor decisions that negatively impact the business. A comprehension of the language of finance enables a person to understand, communicate and take appropriate actions in the interests of the organisation.

To comprehend does not necessarily mean you have to be an expert. As with any language, a working knowledge whereby you can understand and communicate will be sufficient for most people. In the context of an organisation, effective comprehension of the following will suffice:

- How is the organisation performing?

- How does it make money?

- What is the organisation trying to do to improve its performance?

For staff, this means being able to understand their organisation’s strategies and financial objectives. They can recognise and define their organisation’s specific terms, concepts and ratios when it comes to financial performance which can vary from organisation to organisation. They feel confident to discuss this with colleagues which contributes to improved communication. They can read and interpret their organisation’s reports and updates to understand its financial position and performance.

Level 2: Influencing – The ability to recognise how you, within your role, can influence or impact the performance of the organisation.

Once an individual can comprehend and communicate the organisation’s strategy and financial objectives, the focus shifts to their ability to impact and influence the financial performance of the organisation. Here it’s crucial to dive deep into the mechanics of their scorecard and Key Performance Indicators (KPIs).

An effective scorecard is a strategic tool that marries an organisation’s vision with actionable metrics, encapsulating clearly defined strategic objectives, quantifiable KPIs with specific targets, and actionable initiatives aimed at achieving these targets. It assigns ownership to individuals or teams for each KPI and initiative, ensuring accountability, and outlines the data sources for reliable performance measurement. The scorecard should be regularly reviewed, incorporating a performance analysis segment to identify trends and areas for improvement, alongside detailed action plans for addressing any issues. Presented in a visually engaging format, it facilitates swift comprehension and assessment, making it an indispensable compass for steering the organisation towards its strategic goals.

Like any tool, the scorecard is only effective if it is properly constructed. All too often, perhaps due to time constraints or a lack of experience, design flaws creep in. Common mistakes include the temptation to include too many metrics, which can lead to a lack of focus and overwhelm users. A critical mistake is failing to align the scorecard with the organisation’s strategic objectives, resulting in misplaced efforts. Equally detrimental is the oversight of leading indicators, setting unrealistic targets, and poorly defining metrics, which compromise the scorecard’s ability to guide decision-making effectively. Regular updates are essential to maintain relevance, as is clear ownership and accountability for each metric to ensure actions lead to desired outcomes. Additionally, a rigid scorecard that lacks flexibility can impede an organisation’s ability to adapt to changes, while insufficient communication and stakeholder buy-in can hinder its implementation.

Assuming a properly constructed scorecard exists, the onus is then on the individual to understand how to interpret their scorecard and have a good grasp of their KPIs. For instance, if their role involves customer service, understanding how customer satisfaction scores directly impact repeat business and, consequently, revenue growth, allows the individual to fine-tune their strategies for maximum effect. Or, as a project manager, recognising how managing project costs and timelines influences the overall profitability of their projects can elevate their contributions to the organisation’s bottom line.

Especially important is knowing the ins and outs of how their KPIs are measured and the interconnectedness of their colleagues’ and stakeholders’ KPIs with their own. This knowledge can help them align their efforts with the organisation’s overarching goals and foster greater collaboration with their colleagues and the broader team.

For example, the Operations team in a financial services company has a KPI is to reduce transaction processing time by 30% over the next quarter. Another team, the Compliance team, has a KPI focused on reducing the number of compliance breaches by 20% in the same period.

Knowing the Compliance team’s KPIs can greatly assist the Operations team in achieving their goal. For instance, by understanding the Compliance team’s focus on minimising compliance breaches, the Operations team can prioritise integrating compliance checks into the transaction processing workflow from the outset, ensuring that transactions are not only processed faster but also comply with all regulatory requirements. This pre-emptive approach can reduce the need for rework or corrections due to compliance issues, thereby speeding up the overall process. Furthermore, collaboration between the two teams can lead to the development of automated compliance tools that integrate seamlessly into the transaction processing system, ensuring efficiency without sacrificing compliance. Joint training sessions can be organised to ensure that operations staff are well-versed in compliance requirements, thus minimising the risk of breaches during the transaction processing.

This collaborative effort not only helps the Operations team meet their KPI by streamlining processes but also aids the Compliance team in achieving their goal by embedding compliance into the operational workflow, reducing the likelihood of regulatory issues. This synergy between the Operations and Compliance teams ensures that efficiency gains do not come at the expense of regulatory compliance, fostering a culture of operational excellence that aligns with regulatory standards.

Level 3: Budgeting – The ability to prepare, communicate and monitor management plans for the operations and resources of the organisation.

Strategic plans set the high-level direction for the organisation, but this needs to be distilled through the various management teams for it to be implemented. Budgets are in essence the management plans that translate the enterprise-level master plan into actionable steps and targets at the unit and departmental levels. The ability to budget effectively is therefore most relevant for those who have budgetary responsibilities and for those who exercise managerial oversight even where they don’t have any formal budgets to manage.

The term “budgeting” may lead many to think that this is a finance function and therefore should be entrusted to the Finance team alone. While the Finance team play a role in preparing budgets, taking inputs from senior management and the broader management team, ultimate responsibility will rest with the manager for their particular budget. As such, it is in the manager’s interest to be across the budgeting process, what targets have been agreed to as well as shaping the plan to ensure it is relevant and achievable.

The first aspect of developing financial acumen at this level is to understand the organisation’s budgeting process and the manager’s role in that process. Each organisation’s process for developing budgets can vary significantly due to their industry, business model and management approach. In addition, there are many different types of budgets depending on the functional area such as a sales budget, production budget and direct labour budget. Furthermore, there are many different approaches to budgeting such as incremental, zero-based and flexible budgeting. Knowing which approach the organisation uses and which budgets they are responsible can help the manager be better prepared.

Budgets are created using data so it’s important for the manager to be able to analyse and leverage relevant financial data to support their budget. One key data is cost, which requires an understanding of cost behaviours and working out the costs of processes, products or activities. This can form the basis for breaking down their team’s work into specific deliverables, activities and line items within their budget. Sometimes, multiple scenarios may need to be explored and employing tools like Cost-Volume-Profit Analysis can help determine the appropriate course of action and therefore which plan to adopt. Overall, the manager needs to ensure their budget is aligned to the organisation’s strategic goals and plans.

Once a budget has been created, it needs to be monitored to ensure their team remains on track to achieve its goals. The process of monitoring requires an evaluation of the performance of their team versus the budget. This entails an analysis of any variances between the budget and the actuals to understand the reasons behind it and whether any actions are required. Part of this process requires updates to forecasts and potential revisions to the budget. Another important aspect of the monitoring process is to test and manage controls, whether financial or non-financial, so that the organisation does not deviate significantly from its plans without any warning signs escalated to upper management.

Budgets are reliant on people to implement so communication to them is especially important. In general, the communication of the budget objectives, its progress and results are crucial for the alignment and coordination of a team or organisation’s financial strategy. It ensures that all members are aware of their roles, responsibilities, and the expectations set upon them, fostering a collective effort towards achieving financial goals. Clear communication helps in mitigating misunderstandings, managing expectations, and facilitating timely adjustments to the budget as needed. It also enhances transparency and trust among stakeholders and executives, making it easier to secure support and resources for initiatives. Managers can achieve this through regular meetings, detailed reports, accessible dashboards, and open feedback channels. Utilising a mix of formal and informal communication methods, including presentations, emails, and one-on-one discussions, can cater to different information needs and preferences, ensuring that everyone stays informed and engaged throughout the budgetary process.

Level 4: Advocating Change – The ability to proactively promote positive change and affect long term performance of the organisation.

In today’s fast-paced world, where technology evolves rapidly and consumer preferences shift, it’s crucial for businesses to stay adaptable. Those that cling to their former successes risk falling into obscurity. History is full of examples of once-dominant companies that failed to evolve and subsequently vanished.

For a business to remain competitive, its leaders must understand the life cycle of their products or services and know precisely when to innovate or upgrade. This strategy often involves a diverse range of offerings to secure the company’s growth into the future.

A key strategy for ensuring a company’s growth and adaptability involves smart investment decisions. Leaders need to decide where to allocate funds across various projects, considering the timing and amount of investment. This requires a solid grasp of financial evaluation techniques like risk assessment, return on investment, the payback method, Net Present Value (NPV), and analysis of discounted cash flows.

Expansion can take many forms, such as developing new products, merging with or acquiring other businesses, or forming strategic partnerships. These endeavours necessitate a deep understanding of business valuations, how to integrate new acquisitions successfully, and the financial intricacies of such expansions.

Investing in the company’s capabilities is another avenue for growth. This might include hiring more staff, restructuring the company, or adopting new technologies. An essential skill in this area is the ability to develop and assess business cases effectively. These cases are vital tools that help organisations make informed decisions about investments. Many failures can be traced back to poorly constructed business cases, highlighting common pitfalls to avoid.

The Level 4 financial acumen skills will help organisations to thrive in a changing economic landscape, be agile, make informed investment decisions, and continuously seek growth opportunities through innovation, strategic partnerships, and enhancing organisational capabilities.

What level of financial acumen should staff within an organisation possess?

Ideally an organisation would want to have all their staff possess the ability to understand and communicate the financial strategy and performance of their team, business unit and organisation (Level 1) as well as the ability to recognise how they can influence or impact the performance of the organisation (Level 2).

Those with budgetary or managerial responsibilities should possess the ability to prepare, communicate and monitor management plans for the operations and resources of the organisation (Level 3). Finally, those who lead business units or departments should possess the ability to proactively promote positive change and affect long term performance of the organisation (Level 4).

How would you assess the current level of financial acumen of the members of your organisation? Are there any obvious gaps that need to be addressed? Can this framework explain any past experiences of your organisation?

Can you possess a higher level of financial acumen yet lack the lower-level financial acumen?

The financial acumen model is structured like a pyramid, where each level supports and builds upon the one below it. It’s crucial to have a solid foundation, as any missing pieces at the base can create gaps in understanding. These gaps can lead to poor judgment and decision-making. This is dangerous for the organisation unless there are others who can assist or complement to cover the person’s knowledge gaps.

One key challenge here is that it can be hard for an individual to acknowledge a gap in their financial acumen when doing so could be viewed as lacking the competence to do their job. Alternatively, the individual may believe they possess the requisite level of financial acumen but in reality, they do not. Ideally, the organisation can utilise an objective and anonymous means to assessing the level of financial acumen of their staff without exposing them to the potential of losing face amongst their colleagues.

At FTA, our mission is to demystify finance, make the complex appear simple and turn theoretical concepts into practical solutions. Follow us for insightful tips and expert guidance that make finance simple and accessible. Click ‘Follow” and let’s demystify finance together!